The Hidden Cost of Overpricing Your Home: A Denver Market Data Deep Dive

Why "testing the market" with a high price could cost you tens of thousands

If you're thinking about selling your home in the Denver metro area, I have some data that might surprise you—and potentially save you a lot of money.

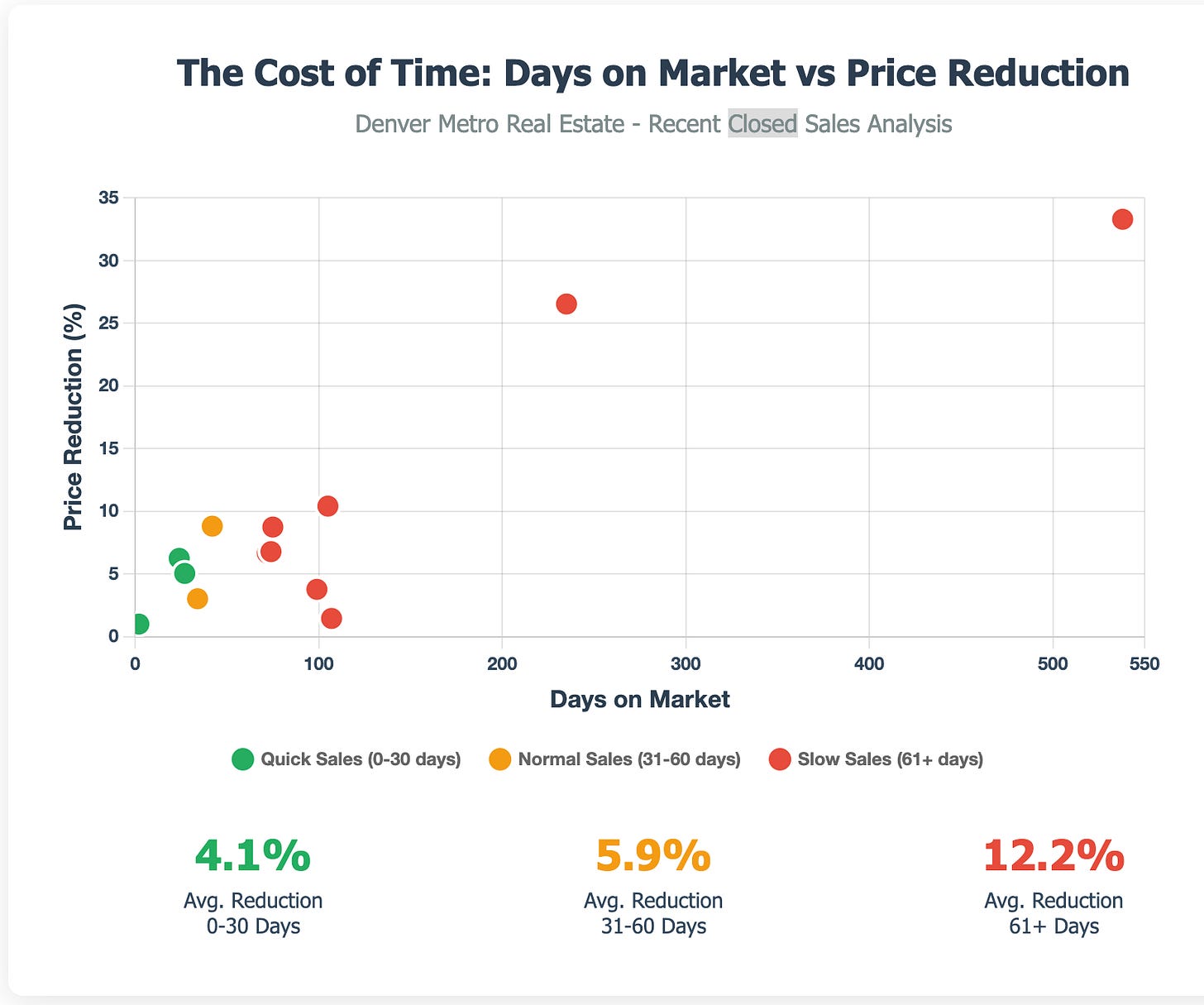

I just analyzed the latest week of closed sales (July 6th to July 12th 2025) across greater Denver, focusing on one critical question: What's the real cost of keeping your home on the market too long?

The answer is more expensive than most sellers realize.

The Numbers Don't Lie

After examining dozens of recent sales from Cherry Hills Village to Commerce City, a clear pattern emerged that every seller needs to understand:

🟢 Quick Sales (0-30 days): 4.1% average price reduction

🟡 Normal Sales (31-60 days): 5.9% average price reduction

🔴 Slow Sales (61+ days): 12.2% average price reduction

But here's where it gets really interesting—and expensive.

The Extreme Cases Tell the Real Story

One Littleton property started at $4.4 million. After 538 days on the market, it finally sold for $2.94 million. That's a $1.46 million loss—or 33.3% below the original asking price.

Another Denver luxury home was listed at $8.95 million. After 235 days, it closed at $6.58 million—a $2.37 million reduction.

These aren't just statistics. They're real sellers who learned an expensive lesson about market timing.

What This Means for You

If You're Selling:

The "test the market" strategy is dead. The data shows that properties priced aggressively from the start actually net more money than those that start high and chase the market down.

Here's why:

Carrying costs add up: Property taxes, insurance, maintenance, and opportunity costs

Market perception shifts: After 45 days, buyers start wondering "what's wrong with it?"

Negotiation power decreases: Desperate sellers make bigger concessions

The sweet spot? Properties that sell in 15-45 days with 3-8% in negotiation room. These sellers maximize their net proceeds.

If You're Buying:

This data reveals clear opportunities:

Fresh listings (under 30 days): Expect competition, move quickly

Properties 60+ days: Serious negotiation opportunities

90+ days on market: Potentially motivated sellers willing to make deals

The Real-World Impact

Let me put this in perspective with a typical Denver scenario:

Example: $800,000 Home

Quick sale strategy (25 days): $800K → $770K = $30K reduction

Extended market time (120 days): $800K → $720K = $80K reduction

Plus carrying costs (4 months): ~$15K additional

Total difference: $65,000

That's a new car, your kids' college fund, or a substantial down payment on your next home.

What the Pros Know

The most successful agents understand this data instinctively. They price properties to sell within 30-45 days, not to "see what happens" at a higher price.

Why? Because time literally costs money in real estate.

Every additional week on the market typically adds 1-2% more negotiation pressure. Every additional month adds 3-5%. And if you hit the 6-month mark? You're looking at potential 20%+ reductions.

The Bottom Line

In today's Denver market, the cost of overpricing far exceeds any benefit of "leaving room to negotiate."

The data is clear: Price it right, price it now, and move on with your life.

Reports are based on information from REColorado®, Inc. for the period shown in title. Note: This representation is based in whole or in part on content supplied by REColorado®, Inc. REColorado®, Inc. does not guarantee nor is in any way responsible for its accuracy. Content maintained by REColorado®, Inc. may not reflect all real estate activity in the market.

Information deemed reliable but not guaranteed. Real Estate Services.